how are rsus taxed when sold

RSUs are taxed when they vest. However it can seem like RSUs are taxed twice if you hold onto the stock and it increases in value before you sell it.

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Once RSU is vested.

. Restricted stock units are fully taxable at the time of vesting. Selling your stock. RSUs are taxed at the ordinary.

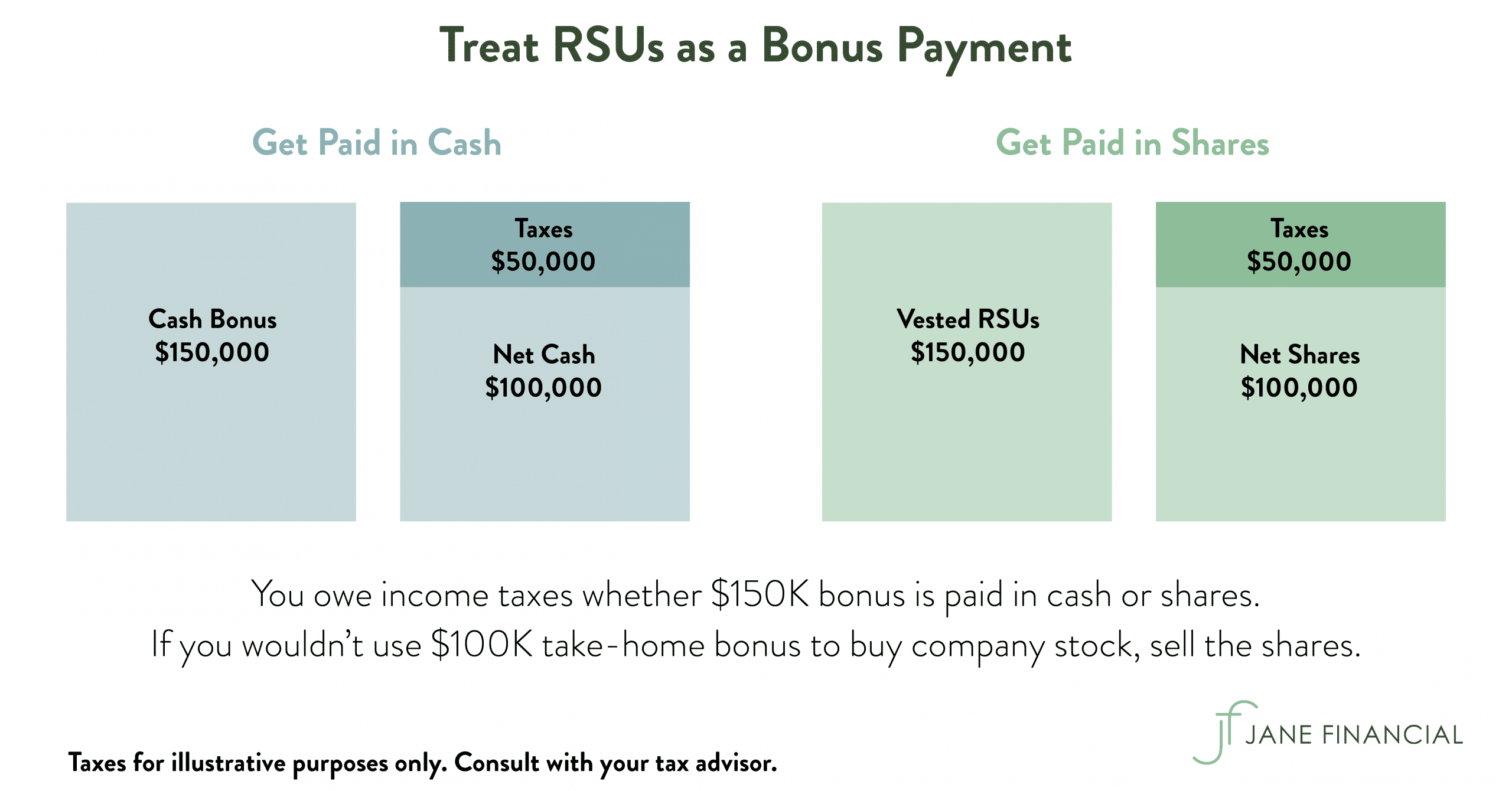

The UK tax treatment for RSUs is similar to how your salary is taxed. Insider trading laws limit when. Just as with a cash bonus RSUs are taxed as ordinary income.

When they vest and when theyre sold. RSUs are taxed as income to you when they vest. The grant date itself is not a taxable event.

Here is how RSUs are taxed. There is a separate capital gains tax that youll owe when you actually sell the stock award too assuming you sell at a gain. Taxes When You Sell RSUs.

Income is reported on the W-2 and shares are withheld to cover tax on the shares. After you take ownership and pay the income tax on the fair. How are RSUs taxed.

Well continue the assumption that you dont. When RSUs are issued to an employee or executive they are subject to ordinary income tax. You only pay tax on RSUs when they vest.

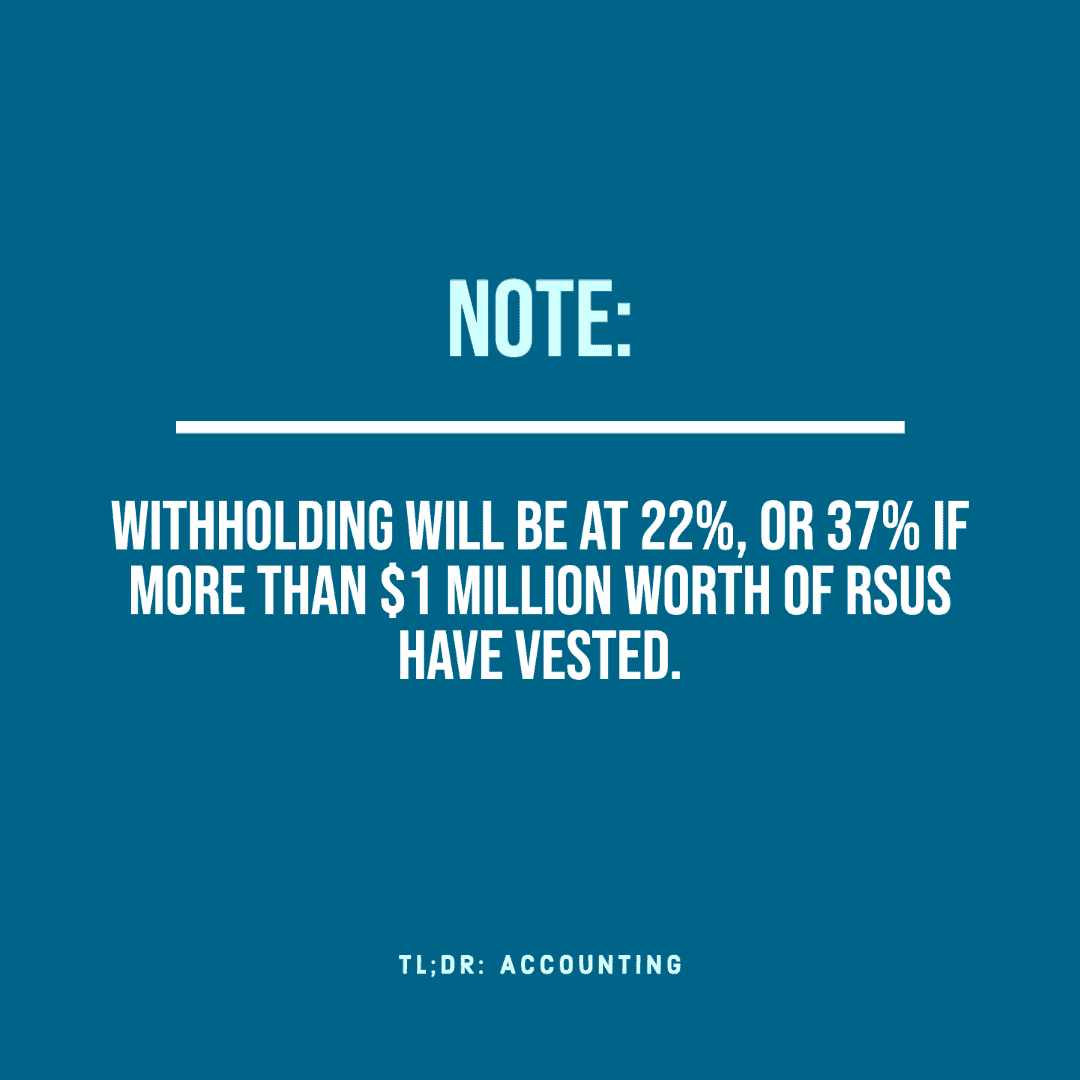

In all cases there is no tax to pay when RSUs are granted. In fact RSUs will only withhold at a rate of 22 until you start making over one million dollars in which case it bumps up to 37. If you sell them within a year of vesting.

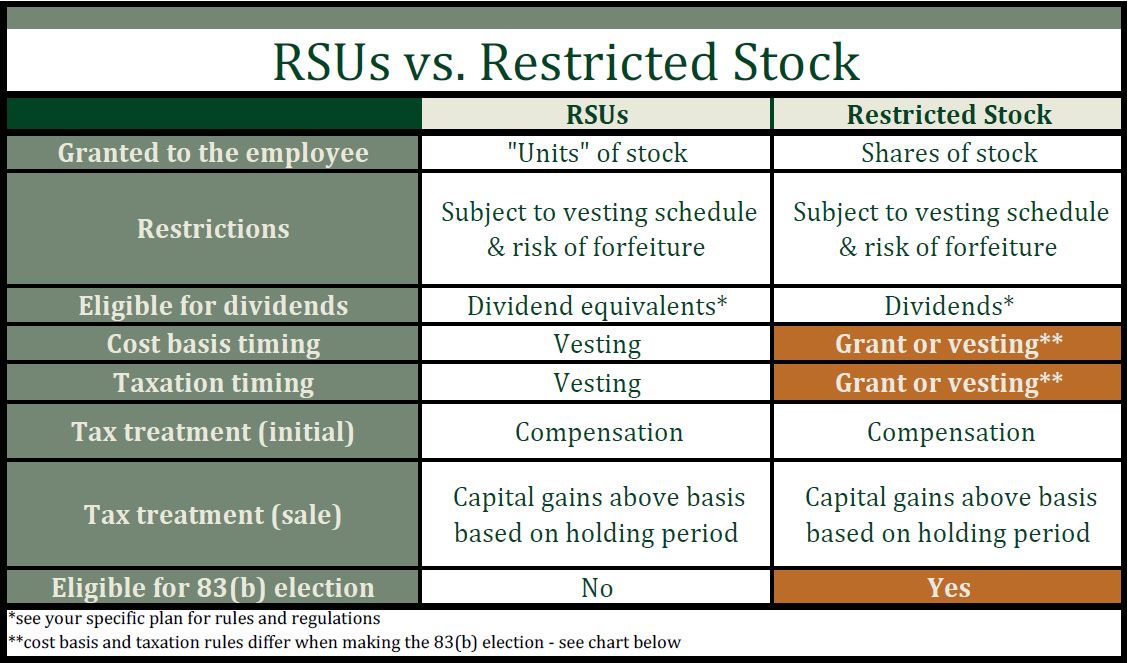

However if the shares are retained after the vesting date any gain or loss is taxed as. The amount will be based on. The recipient is taxed on the value.

The chart above shows that the employee sold some of the shares each year to pay taxes. If the price the share is sold at is higher. How RSUs are taxed at vesting differs from how they are taxed when the shares are sold.

Youll likely have to pay taxes again if you sell stock you received through an RSU or a stock grant. Any change in value after that is capital gain or loss - short term for holding periods up to a year long term beyond that. Capital gains tax only applies if the recipient of RSUs does not sell the stock.

No RSUs are not taxed twice. RSUs are generally taxed at two points in time. This means that if youre above the 22 tax.

If you sell your shares immediately there is no capital gain tax and you only pay ordinary income. RSUs are taxed when they vest. Nothing else is reported on the tax return until the shares.

If you hold on to your RSU stock and the stock gives you dividends then youll have to pay. How are RSUs taxed. Pay income tax on the shares.

If you sell your shares promptly you avoid capital gains tax and incur only income tax. Upon vesting the amount is considered as ordinary income.

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Sell Your Rsus As Soon As They Vest

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

Should I Hold Or Sell My Rsus Sofi

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Solved How To Report Rsu That Were Sold To Cover Taxes I Have Done Extensive Research And I See Multiple Options On Turbotax To Do This Each Leading To Different Tax Due

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

A Guide To Restricted Stock Units Rsus And Divorce

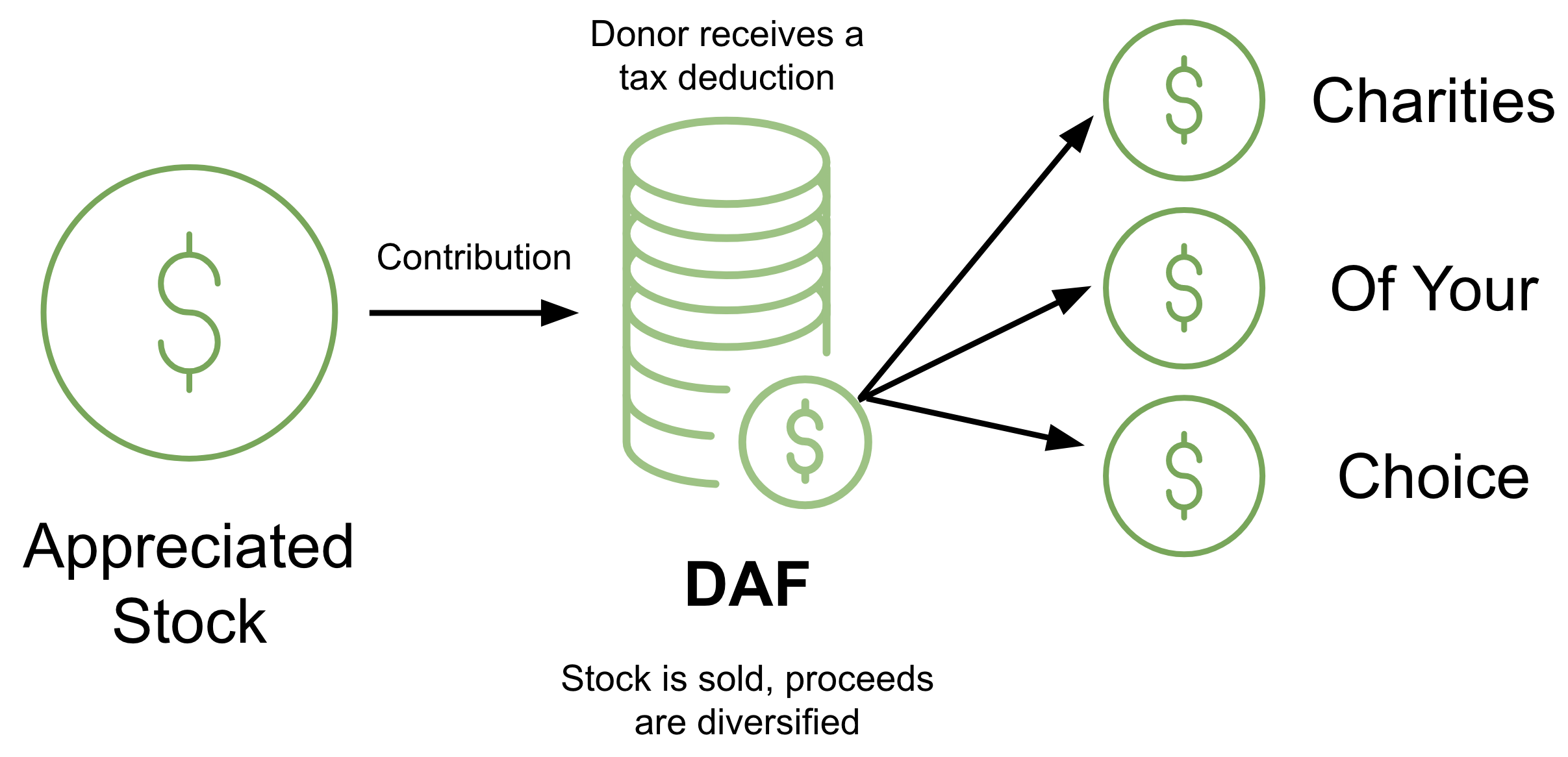

How To Avoid Taxes On Rsus Equity Ftw

Common Rsu Misconceptions Brooklyn Fi

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Restricted Stock Units Or Rsu S Explained Wiser Wealth Management

Rsu Taxes Explained 4 Tax Strategies For 2022

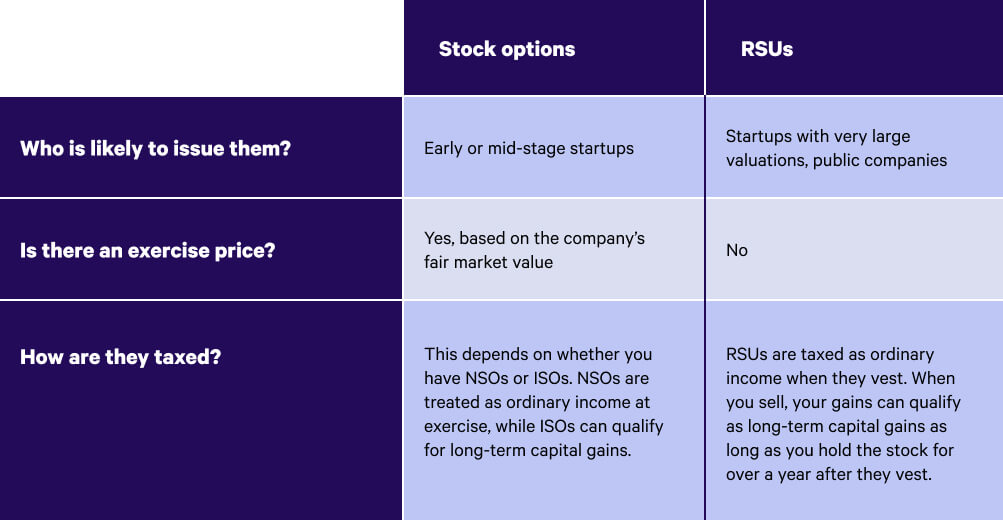

Rsus Vs Stock Options What S The Difference Wealthfront

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc